Competition in Biomethane Market in Spain – Major Upgrading Suppliers Are Already In

By Ryan Hart, BiogasWorld

The enormous potential of the Spanish market has sparked a new competition between the major upgraders of Europe and North America within the market.

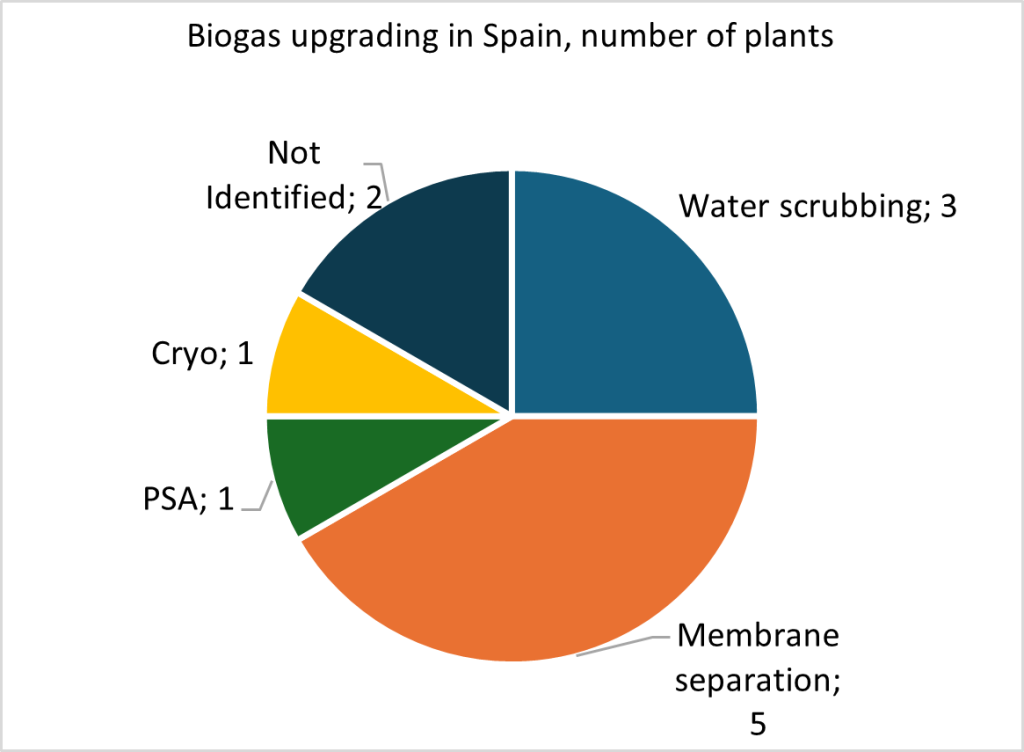

Currently, the membrane upgrading dominates the space as the most popular technology, at 5 out of 12 operational biomethane sites. Other competing technologies include water adsorption, cryogenic, and pressure-swing adsorption.

Bright Renewables and DMT have supplied the membrane systems for both of Spain’s operational WWTP systems. Bright has set up a central system to process gas from two nearby digesters in Barcelona, a WWTP and an SSO digester. DMT developed the first system in the Galicia region of Spain, which processes sewage gas for injection and use as vehicle fuel.

In the Spanish capital, a major site for the processing of Madrid’s household food waste is supplied by Greenlane’s water adsorption system. The site supplies gas for use within the technology park, and for injection into the local energy grid.

As for landfills, in Catalonia, WAGA Energy has designed and supplied their cryogenic systems at one of the largest landfills in the county. Commissioned in June 2023, the facility will mitigate approximately 17,000 t CO2e/year.

The remaining systems designed for agricultural projects are located across the country, and are supplied by Sysadvance (PSA), AGF (water adsorption), and FNX (membrane).

In conclusion, Spain features a diversity of upgrading technologies, and while membrane systems are the preferred technology at the majority of operational sites as of now, it is to early to determine whether this trend will continue. With contributions from companies including WAGA Energy, Bright Renewables, DMT, Greenlane, Prodeval, Sysadvance, AGF, and FNX, Spain is making significant strides towards mitigating its emissions and the transition to the circular economy.