What is the state of biogas and biomethane market in France?

UPDATED: June 25, 2020

The biogas and biomethane market in France is among the most dynamic in Europe according to the latest data available. With its continued growth and the actions taken by the government to become carbon neutral as soon as 2050, the France market should offer interesting business opportunities in the next years. Despite obstacles, financial support and policies offered remain beneficial. Here is a glimpse into the biogas and biomethane France market.

French biogas and biomethane industry in numbers

As of December 2019, according to the 2019 Renewable Gas Panorama and the Biomethane Observatory, published in May 2020:

- The quantity of biomethane injected into French distribution networks has reached 1235 GWh in 2019, which is 73% more than it was in 2018.

- The quantity of BioNGV that was used by vehicles as a fuel reached 250 GWh. Also, 21 500 vehicles used NGV as a fuel. France is one of the most dynamic market in Europe in this regard, especially when it comes to heavy-duty vehicles.

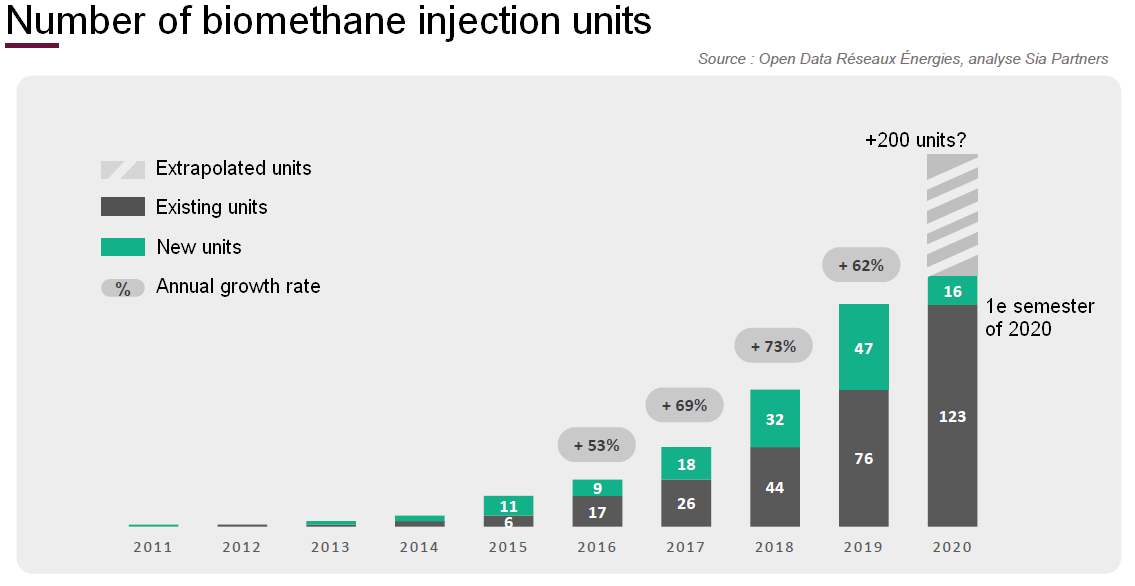

- 123 plants, out of a total of 860 (+62%), were injecting biomethane into the natural gas distribution systems.

- At the end of 2019, there were 738 biogas units producing electricity and heat. It accounts for 86% of all biogas plants in France.

- 1085 biomethane injection projects are at different step of development, with a cumulative potential production capacity of 24TWh / year. It is an increase of 10TWh in comparison with 2018. It is the equivalent of 106 000 BioNGV bus or trucks!

Source : Biomethane Observatory, France Biomethane, May 2020

The development of more than 200 biomethane units is planned for this year, according to the previous graphic. However, this number could decrease because of the COVID-19 crisis.

The crisis had consequences for the industry such as a slowdown or closure of sites, delays in administrative procedures and the reduced quantity of organics available because of restaurants closure, for example. The French government has adopted policies to support the industry and minimize the consequences.

In addition, the majority of biogas plants use feedstocks from agriculture and that are directly available on the territory is it located on, such as manure, culture residues or wastewater sludge. The production of biogas and biomethane in France is based on the valorization of waste and agricultural, industrial or municipal by-products. Biomethane has specifically a high potential in these sectors. Unlike some countries like Germany, it does not practice culture used for production of energy.

Source: Biomethane Observatory, France Biomethane, May 2020

The French government actively supports the growth of the industry

For several years, the government of France has actively supported the growth of biogas and biomethane. The market mechanisms and the various subsidies offered make it possible to reduce the high costs of production.

Fixed purchase tariff: market mechanisms for producers

These market mechanisms give producers the certainty of selling a certain amount of biogas and biomethane to a selected supplier at a previously fixed price and for a fixed term. These are the pillars of government support for the industry.

These purchase tariff, determined by the government, depend on several factors, such as the form of valorization used, the size of the unit and the nature of the feedstocks.

There are two types of fixed purchase tariffs:

- For biomethane injected into natural gas networks

The duration of the purchase obligation is 15 years, and allows to reduce the costs of production and operation. On December 31, 2018, the purchase tariff for renewable natural gas plants was between 45 and 139 € / MWh, depending on their size. A bonus may be added depending on the type of feedstocks used.

However, the new multiannual energy programming (PPE), adopted in April 2020, plans for a gradual reduction of these tariffs. The goal is to reach a target price of 75 € / MWh in 2023, and 60 € / MWh in 2028.

Moreover, the government wishes to set up a tendering system for about 20 units of 200 Nm3/h, or medium-sized. A tariff can be suggested in the tender. After, if money remains, it could be offered to smaller facilities. These changes should be implemented in 2020.

- For electricity produced from biogas

For this type of biogas plant, the duration of the purchase obligation is 20 years. When the biogas plants exceed a power of 500 kW, they go through a formal bidding process. This purchase price has allowed for strong growth incogeneration in agricultural areas.

Source : Panorama du gaz renouvelable 2019, May 2020

For more information, visit the Ministry of Ecological and Solidarity Transition and CEGIBAT websites.

Guarantees of origin: a contract with benefits

Guarantees of origin (GO) bind the biomethane producer and the gas supplier for 2 years. The gas supplier receives a guarantee of origin for each MWh of biomethane produced. This disappears from the register as soon as the MWh is consumed.

However, the last version of the energy-climate law, adopted in 2019 and aiming to reach carbon neutrality by 2050 will bring changes to this mechanism. For example, the government will own the guarantees of origin and will sell them as bids to the gas suppliers. Before, they were paid by gas purchasers such as ENGIE. These changes should start in November 2020. It could change the financing capacity of this mechanism.

Successful Projects in France and elsewhere around the world

Released in September 2021, our Showcase Report 2021 highlights over 65 successful stories within the industry from BiogasWorld members, including Waga Energy, Prodeval, BTS Biogas, HoSt Bioenergy, Veolia and more. From large-scale projects converting organic waste to energy, to small-scale anaerobic digestion systems, renewable natural gas can be used in various fields of applications.

Our free report has been designed to introduce you to these technologies and services, presented in a short description highlighting their results and benefits. You will get a glimpse into which technologies and services are currently offered in the biogas and biomethane market all over the world.

Other biogas and biomethane incentives in France to accelerate the energy transition

Over the years, the government of France and other organizations active in the biogas and biomethane industry have enhanced the financial incentives offered. The goal is to stimulate French industry and reduce the costs associated with the production and operation of biomethane or biogas units.

Here are some examples of financial incentives you could benefit from:

- Grants and technical aids offered by ADEME, local authorities, water agencies and others;

- The exemption from the domestic consumption tax on natural gas (TICGN) now also applies to biogas or biomethane mixed with natural gas. It has been extended to January 1st 2021.

- In 2017, the French government also set up:

- Tariff rebate of up to 40% on the costs of connecting biomethane facilities with the distribution network

- Biomethane injection permitted in underground storage locations

Multiannual energy programming: towards an energy transition that includes biogas/biomethane

In April 2020, the French government adopted its multiannual energy programming (PPE), after spending several months revising it and some public debates. Multiannual energy planning allows France to set itself targets and priorities in order to make the necessary energy transition.

Biogas and biomethane took a lot of space during the discussions about the PPE. They have been recognized as important drivers for the energy transition. However, the space they got in the new PPE is reduced, which disappointed several stakeholders of the industry.

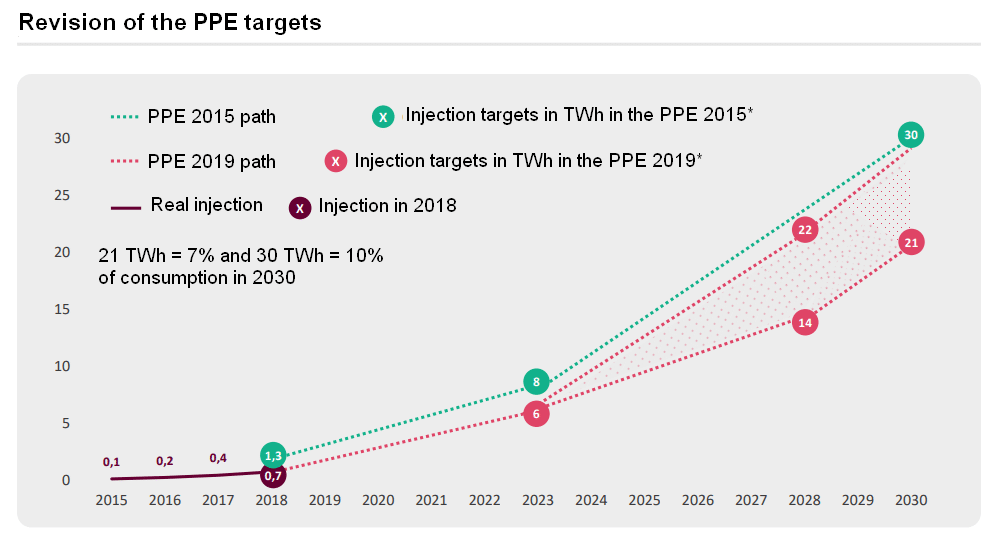

Indeed, they fear a slowdown in the number of projects in the future because of the decreasing purchase tariff for biomethane injection in the gas grid. Also, the French government has decided to decrease the renewable gas in the gas grid target to 7% by 2030. Before that, the target was at 10%, and the industry hoped the government would choose a target of 30%.

Project developers will have to reach an injected capacity target between 14 and 22TWh for 2028. This number is lower than the imagined scenario in the PPE 2015 for the same year. This is a way for the French government to encourage a cost reduction and an increase of profitability for the industry. The biogas and biomethane industry want to set up cost reduction levers and report the decrease of the purchase tariff. They believe the new PPE project may be detrimental to small-scale or agricultural projects.

Source: Biomethane Observatory, France Biomethane

Obstacles to overcome

Despite the continued growth of the biogas and biomethane industry, some obstacles remain.

A recent study by ATLANTE, the Advent of the 3rd Gas Revolution, mentions, for example:

- High production and processing costs;

- Irregular and seasonal demand;

- The compartmentalized distribution network;

- Administrative procedures that are sometimes long and complex.

However, there are several solutions for these problems: the use of new technologies, the implementation of regulatory changes and others. The actors involved in the industry are working to mitigate these obstacles to optimize its development.

Business opportunities in biogas and biomethane at your fingertips

Despite the obstacles mentioned, the adopted measures set up for the biogas and biomethane industry and the actions of organizations and companies unquestionably create interesting business opportunities in France for project developers and suppliers. This will become increasingly true as France moves towards carbon neutrality and seeks to reduce its GHG emissions. The latest data and studies about the France market prove without a doubt it has a remarkable dynamism and a growing potential.

They also want to decrease by 40% its consumption in fossil fuel. In addition, a report by ADEME is studying the feasibility of a 100% renewable gas mix by 2050.

Several companies in France are already benefiting from the market, such as:

This company valorizes biogas from waste storage facilities with its WAGABOX.

Prodeval is specialized in treatment and recovery of biogas issued from methanisation of organic waste systems.

It is a global leader in the biogas purification industry. They offer systems with a capacity ranging from 70-12 000 SCFM.

A company specializing in the construction of biogas plants in the agricultural and industrial industry, in particular.

A company with expertise in the technological development of biomass flows and the supply of renewable energy system.

A company specializing in gas separation technologies for biogas upgrading, nitrogen production and helium recovery, among others.

Get closer to the French market!

As BiogasWorld always strives to take the pulse of the market and meet its actors, we actively participate in the biogas and biomethane industry in France. Every year, we take part in several events in France to follow the growth of the market and learn to know better the stakeholders.

We stay in touch with several project developers and suppliers that are active in France.

Are you interested by this market? Or maybe you are looking for products or services suppliers in France? Have a look at our industry directory through your BiogasWorld account or free catalogue.

To know more :

- Mapping the state of play of renewable gases in Europe, REGATRACE

- Multiannual energy programming, le ministère de la Transition écologique et solidaire

- Le panorama du gaz renouvelable 2019, GRT Gaz

- Energy-Climate law definitely adopted by the Parliament, Connaissance des énergies

- Observatory of biomethane, France Biométhane

- Territorial biogas : for a return of biogas in the PPE, L’Énergeek

- Renewable Energy: the biomethane only grows accelerates on the first semester , Actu-Environnement